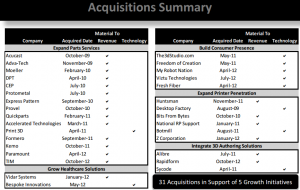

Recently I have been looking more and more at the infrastructure that companies are building in order to deliver 3D printing to a broader customer base. 3DS has also bucketed this consumer presence with the 5 acquisitions they have made toward their goal “Build Consumer Presence”. Notably none of these consumer presence companies were acquired for their revenue. Certainly 3DS is not acquiring them with the goal to lose money but the “Technology” reason to buy them also seems a bit thin especially considering the scope of the existing tech from each.

The transcript of the call notes: $19.6 million that we paid for the 10 early stage start-ups that we acquired for their proprietary R&D assets, know-how and technology building blocks. I could not find more details on the price paid for each acquisition but this of course averages to about $2MM per technology acquisition and it’s a safe assumption that the spread on actual price brings 1-2 below $1MM and at least 1-2 over the $3MM mark. For now I want to capture some thoughts on each of 5 acquisition that build consumer presence.

The3DStudio.com: My initial reaction is that this “Acqusition” is really a buyout to get a single asset… a domain name. It’s a good one, and given the scope of the current content on the site and ads running it’s clear that ad revenue would not materially effect 3DS bottom line. The technology portion of this could be the materials, textures, and 3D models that are sold but most of them are user generated. Certainly rolling some of these into the Cubify world to be sold and printed easily on existing machines would help increase value and improve the consumer experience but the site will need an overhaul to have the look and brand feel of the rest of the 3DS portfolio.

This is not a knock on The3DStudio team, they look built a robust site that delivers sales from various users. Some of the models can be quite expensive, but with overthere is nothing about the infrastructure of the site, product offering, or content that is proprie. Maybe 3DS got a great deal on it and the domain, access to mailing lists, and small revenue made it a break even while they wait for a bigger plan for the site but it seems a bit confusing otherwise.

Freedom of Creation:

This is a design house who gathers designs and input from an international community and then focuses on bringing to market (or production at least) those designs. Everything from marketing installations to consumer products are available. If nothing else Freedom of Creation showcases what 3D Printers can do and it’s pretty clear they want to help provide people with cool things to print. Their “About Us” states:

We believe in a future where people will have 3D printers at their homes and they can just download files for products from the internet and produce them by themselves.

I was also intrigued by Freedom of Creation Talents, a design competition. Products are submitted and the winners have the chance to be used for production goods in exchange for a licensing fee. It doesn’t seem like 3DS wants to be the the business of manufacturing but if you can manage to get a bunch of quality designers to willingly hand over their hard work that can’t be bad. Treat that community well and they are likely to be great customers who will continue to want access to low cost production.

My Robot Nation:

Who doesn’t want a custom robot? That’s what robot nation makes at their online shop. All a user has to do is sign in and start selecting from the different styles of arms, heads, etc. I am a toy maker in my day job and understand the draw of creating a cool thing and having it made for immediate consumption. The prices for My Robot Nation’s custom prints are significantly more than standard action figures (a 6” figure is advertised at $170) but with continued developments of printers that cost is likely to drop. The user base who is willing to pay $170 for a single figure is probably similar to those willing to spend $1k+ on their own printer so maybe not a bad move for 3DS in terms of picking up consumer presence (the right consumer presence).

|

| My Robot Nation Home Page |

Viztu Technologies (and Hypr3D):

This is an interesting company to buy for the “Consumer Presence”. Viztu makes scan to 3D applications which can transform video or pictures of an object into a 3D model of it. There is not much of an installed user base but the technology is a great addition for 3DS. Interestingly they have started to make this technology connect to other items in the 3DS stable, namely Cubify and the Cube 3D printer, the application can take your favorite photo and automatically create the raised surface for printing on a custom iPhone case. One of their handy applications can be seen in the video below.

Fresh Fiber: Another company for custom 3D printed materials. Fresh Fiber creates a variety of 3D printed cases for phones, tablets, and mobile devices. I can see how this adds consumer presence, considering how prominently people display their phones. That being said I still can not find out what about the technology is so unique that 3D Systems was encouraged to buy. Fresh Fiber advertises products made by “international artists and designers”. It appears to me that a handful of talented designers, a basic web storefront, and some investment in 3D printers is all Fresh Fiber has. I do not mean that to take down the team at Fresh Fiber, their products all look very well designed and the website is professional but it is difficult to understand what about the technology is proprietary. The may be a back end link to allow ordering in retail stores (the Fresh Fiber site shows a list of retail locations but does not show what service is available there) and I would like to learn more.

This is a fantastic article. Are you planning on doing an update for the acquisitions of 2013?

Thanks and keep it up.

Mike

This is a fantastic job. Are updating this article for the acquistions of 3DS in 2013?

Thanks and keep it up